Did you know that the way you own property with others can affect your rights?

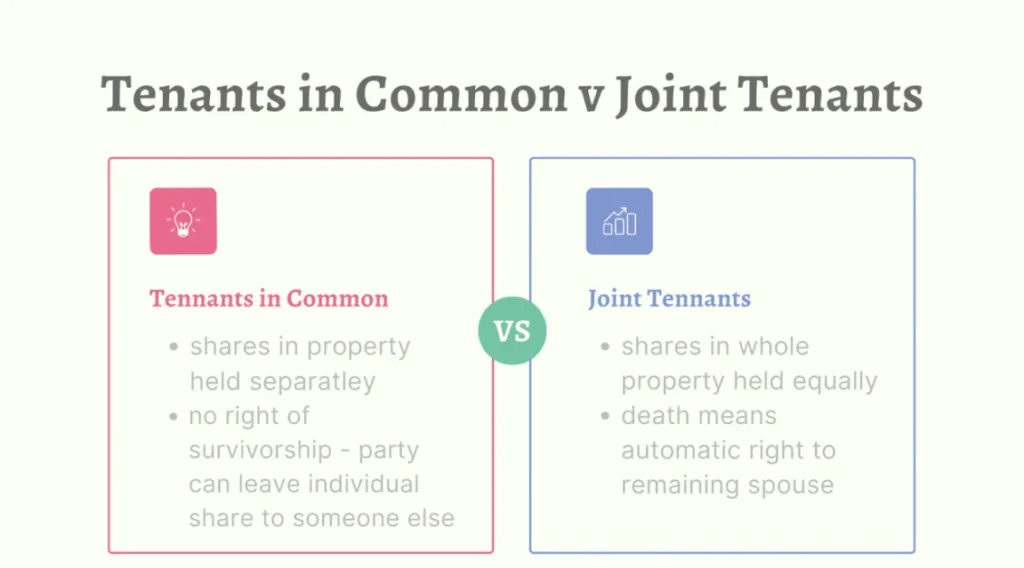

Tenants in common and joint tenants are two common ways to share ownership, but they are not the same. One lets each person own a separate share that can be passed on, while the other means all owners have equal rights, and the property goes to the other owner if one passes away.

Knowing these differences can help you make the best choice for your future. Keep reading to find out which option works best for you!

Ownership Shares

Property ownership can be divided in different ways depending on the type of co-ownership chosen. With tenants in common, each owner can hold a different percentage of the property. One person may own 60%, while another owns 40%.

These shares are separate and can be decided based on contributions or agreements. Joint tenants, on the other hand, always have equal shares. If there are two owners, each holds 50%.

If there are three, each gets one-third. This equal split applies no matter how much each person contributes. Understanding ownership shares is key when comparing tenants in common vs. joint tenants, as it affects control over the property and future decisions.

Inheritance Rights

What happens to a property when an owner passes away depends on the type of ownership. With tenants in common, each owner can leave their share to anyone in a will. This means family members, friends, or even charities can inherit the property.

If no will exists, the share follows standard inheritance laws. Joint tenants, however, have a different rule. When one owner passes away, their share automatically transfers to the remaining owner(s), no matter what a will says.

This process is called the right of survivorship. Choosing the right ownership type is important, especially when planning for a large inheritance, as it affects how property is passed down to future generations.

Selling a Share

Owning property with others does not always mean being tied to it forever. With tenants in common, each owner has the freedom to sell their share without needing permission from the others. This makes it easier to leave the arrangement or bring in a new co-owner.

The buyer then becomes a new tenant in common with the remaining owners. Joint tenants, however, do not have this option. The entire property must be sold together, requiring all owners to agree.

If one owner wants to exit, the joint tenancy must be broken first. Understanding these rules helps co-owners make informed decisions about their rights and future flexibility when it comes to selling a property share.

Legal Setup

Property ownership can be structured in different ways depending on how it is acquired. Some co-owners may purchase a property together at the same time, while others may join later.

Certain ownership types allow new owners to be added at any point, while others require all owners to enter the agreement simultaneously. These legal rules shape how ownership is formed and can affect future decisions about the property.

Understanding Tenants in Common and Joint Tenants Helps You Choose Wisely

In conclusion, choosing between tenants in common and joint tenants depends on your goals and needs. Whether it’s deciding how to divide ownership, plan for inheritance, or sell your share, understanding the differences helps you make the right choice.

Knowing the key features of each option can ensure that your property ownership fits your long-term plans and avoids unexpected complications.

Did you find this article helpful? You can check out our website for more awesome content like this.